Current Share Price Overview & Key Metrics

HSBC Share Price: HSBC Holdings plc is a global banking and financial services company listed across multiple exchanges, including London (HSBA), New York (ADR: HSBC), and Hong Kong (0005.HK).

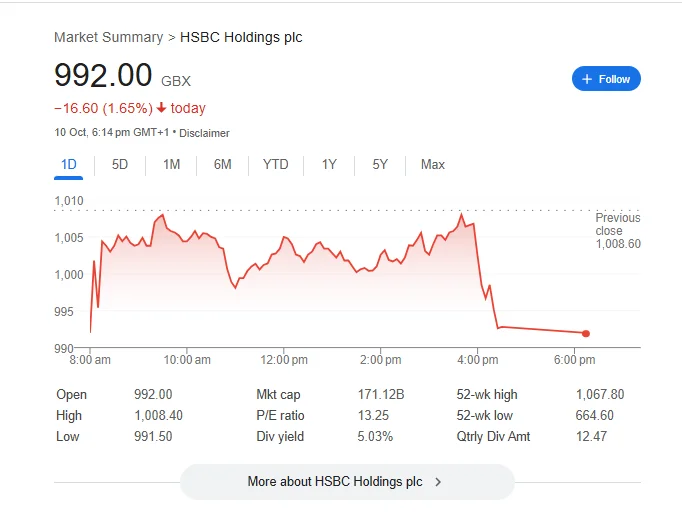

As of the latest data:

- On the U.S. ADR, HSBC trades around US $65.92 per share.

- On the London market, its shares were quoted at GBX 1,050.00 (or GBP 10.50) in recent trading sessions.

- In Hong Kong, the local listing (0005.HK) closed recently at HKD 67.30.

Other key metrics to watch include:

- 52-week highs/lows: The U.K. listing has ranged between GBX 662.70 and GBX 1,067.80.

- On the U.S. listing, HSBC recently hit a 52-week high near US $62.87.

- Valuation and profitability: The LSE listing shows a price-to-earnings (P/E) ratio of ~14.38 and a dividend yield of ~4.68%.

- Recent earnings: HSBC reported earnings per share of US $1.95 in the last quarter, beating expectations (~US $1.62).

These figures provide a snapshot of where HSBC stands in market valuation and investor expectations.

Drivers Behind HSBC’s Share Price Movements

Several internal and external factors influence HSBC’s share price behavior:

1. Strategic Moves & Acquisitions

In October 2025, HSBC proposed acquiring the remaining 36.5% stake in Hang Seng Bank, paying a substantial premium, valuing the subsidiary at ~$13.6 billion. This decision triggered a ~6% drop in HSBC’s share value

To fund the acquisition, HSBC will pause stock buybacks for several quarters, which has disappointed some investors who expected capital returns.

2. Earnings & Profitability Performance

HSBC’s better-than-expected EPS recently buoyed sentiment and reinforced confidence in its core banking operations.

Yet HSBC has also faced headwinds. At one point, its quarterly profit plunged by 80%, driven by writedowns, impairments, and exposures (notably in Chinese banking). This sort of earnings surprise can lead to sharp share declines.

3. Cost Reduction & Structural Reshaping

Under CEO Georges Elhedery, HSBC is pushing cost-cutting initiatives, restructuring operations, and simplifying its organizational structure.

The bank also announced a new $2 billion share buyback program in some periods and targets $1.5 billion in expense reductions by 2026.

4. Macro & Regional Risk Exposure

HSBC’s heavy exposure to Asia, China, and Hong Kong means its fortunes are affected by property sector stress, credit cycles, regulatory shifts, and geopolitical tension

For example, rumors of property debt distress in China and currency pressures have led to caution among global investors.

5. Legal, Regulatory & Market Sentiment

In South Korea, a court cleared HSBC’s unit of charges related to illegal short-selling. The decision removed potential regulatory overhang.

Investor sentiment and market momentum also play a role. Banking shares in general tend to be sensitive to interest rate expectations, credit spreads, and central bank policy.

Together, these drivers create volatility but also opportunity in HSBC’s share price dynamics.

Risks & Challenges Facing HSBC’s Shares

While HSBC offers a global platform and strong brand, its stock is not without risks. Here are some of the key challenges investors should monitor:

Valuation Risk vs Overpayment

The Hang Seng Bank acquisition is bold—but paying a high premium and foregoing buybacks could erode value. If the integration or synergies fall short, the deal might weigh negatively on returns.

China & Hong Kong Exposure

HSBC earns a large portion of profits in Greater China. Deterioration in real estate, tighter regulation, or currency volatility in that region could hurt earnings.

Regulatory & Compliance Pressures

Operating across many jurisdictions subjects HSBC to evolving banking regulation, macroprudential oversight, and capital requirements. Unexpected regulatory changes can affect profitability and capital allocation.

Competition & Market Disruption

Fintech competition, digital banking erosion, or emerging challengers in Asia and elsewhere may compress margins or take market share from HSBC’s core banking units.

Interest Rate Sensitivity & Funding Costs

Banks generally benefit from rising interest rates (wider net interest margins), but rapid rate changes, yield curve inversion, or high funding costs can pressure earnings.

Litigation & Reputational Risk

Multinational banks often face lawsuits, regulatory investigations, or compliance failures. Negative outcomes could damage public perception or capital reserves.

How to Analyze & Trade HSBC Shares Wisely

If you’re considering investing or trading HSBC’s stock, here are some useful strategies and metrics:

Use Multi-Market Views

Because HSBC trades in multiple exchanges, compare price movements across ADR (U.S.), LSE, and HK listings to gauge arbitrage opportunities or sentiment divergence.

Monitor Capital Actions & Announcements

Stay alert to announcements like new buybacks, acquisitions, dividend changes, or share issuance, as they often precede sharp moves. HSBC’s investor relations pages publish these updates.

Focus on Core Metrics

Key fundamentals to watch include EPS growth, net interest margin, cost-to-income ratio, loan impairment provisions, and capital ratios (CET1).

Watch Macro Indicators

Interest rates, currency strength, global economic growth (especially in Asia), and property market indicators are leading signals for banking performance.

Use Technical Analysis for Entry/Exit

Identify support/resistance zones, trendlines, and volume spikes in HSBC’s share charts. These can help time entries or exits, especially during volatile periods.

Hedge with Options or Pairs

If available, use options to hedge downside risk or trade pairs (e.g. HSBC vs regional peers) to isolate idiosyncratic exposure.

By combining fundamental insight with tactical awareness, you can approach HSBC shares more strategically.

Outlook & What Investors Should Watch

Looking ahead, the trajectory of HSBC’s share price will likely depend on a few pivotal developments:

- Results of the Hang Seng acquisition: Whether HSBC can monetize synergies, avoid overpaying, and prevent capital dilution will be central.

- Execution of cost cuts & restructuring: If Elhedery’s plan delivers increased efficiency without revenue downside, it could be a tailwind.

- Asia economic dynamics: Real estate health, China growth, and regional stability will significantly affect HSBC’s returns.

- Dividend policy & buybacks: Returning capital to shareholders continues to be a key concern; any pause or reduction may spook the market.

- Regulatory or credit shocks: Unexpected banking sector turbulence or tightening could test HSBC’s resilience.

- Global interest rates: The direction and pace of rate changes will influence bank profitability over medium term.

Overall, HSBC’s shares offer potential upside if it balances bold moves with prudence, especially given its global footprint and significance in Asia-West banking corridors.

Conclusion

HSBC’s share price is shaped by a mix of global banking fundamentals, bold strategic decisions (such as the Hang Seng takeover), performance of its core operations, and macro exposures in Asia. While the stock offers income potential via dividends and a chance at capital growth, it also faces meaningful risks due to its complexity, regulatory environment, and regional sensitivities.